Safeguarding an Equity Loan: Actions and Needs Clarified

Unlock Financial Possibilities With a Home Equity Financing

Consider the possibilities that lie within utilizing a home equity finance. As we explore the technicians and benefits of home equity loans, you could uncover a course to unlocking covert financial potential that can reshape your monetary landscape.

Advantages of Home Equity Loans

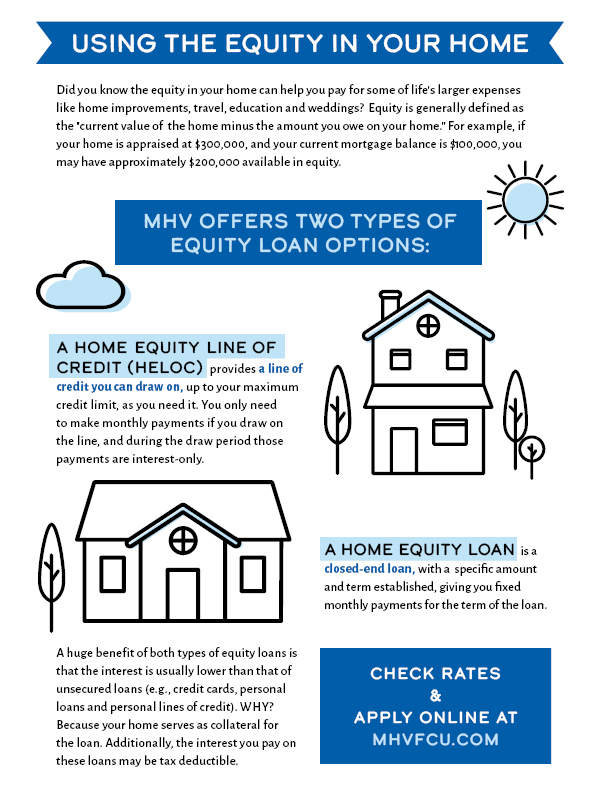

Home Equity Fundings supply property owners a practical and versatile financial solution for leveraging the equity in their homes. Among the primary benefits of a Home Equity Financing is the ability to access a big sum of cash upfront, which can be used for various purposes such as home enhancements, financial obligation loan consolidation, or financing significant costs like education and learning or clinical bills. Home Equity Loans. Additionally, Home Equity Finances commonly come with reduced rates of interest contrasted to various other sorts of finances, making them a cost-efficient loaning alternative for house owners

Home Equity Lendings commonly have longer repayment terms than various other types of loans, enabling borrowers to spread out their settlements over time and make handling their finances a lot more convenient. Generally, the benefits of Home Equity Car loans make them a beneficial tool for property owners looking to open the financial capacity of their homes.

How Home Equity Loans Work

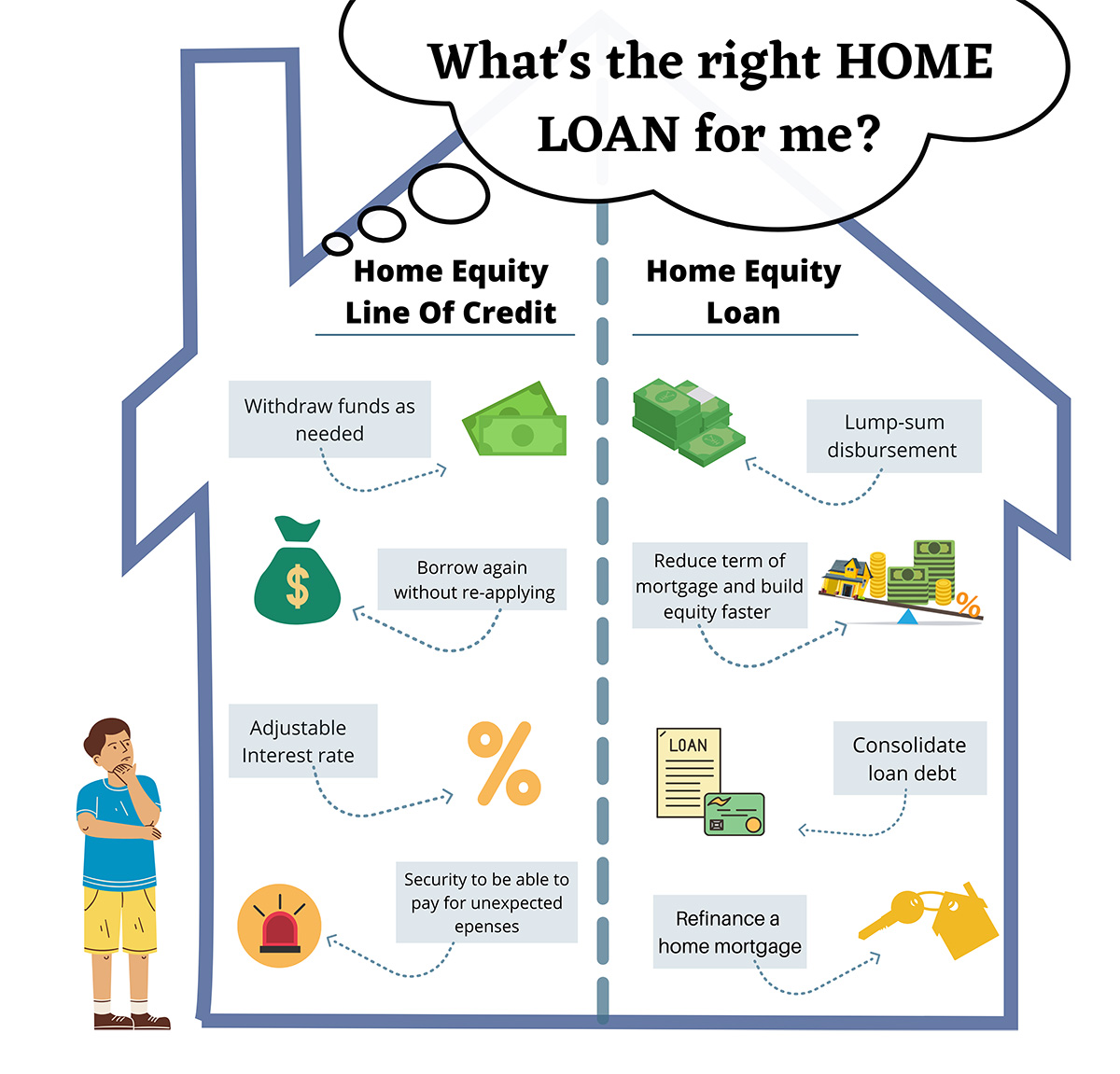

Provided the substantial benefits and advantages detailed regarding leveraging the equity in one's home, understanding the auto mechanics of just how equity loans operate ends up being critical for homeowners seeking to make educated monetary choices. Home equity financings are a kind of funding in which the debtor makes use of the equity in their home as security. Equity is the distinction in between the evaluated worth of the home and the superior home mortgage equilibrium.

When a homeowner uses for a home equity funding, the loan provider evaluates the worth of the residential property and the amount of equity the consumer has. The rate of interest paid on a home equity lending might be tax-deductible, making it an appealing option for house owners looking to finance significant expenses or settle high-interest financial obligation. Recognizing the terms, payment structure, and prospective tax advantages of home equity lendings is crucial for house owners considering this financial choice.

Using Home Equity for Restorations

Utilizing the equity in one's building for remodellings can be a critical monetary action that not only boosts the living area yet also includes value to the home. Home equity financings provide homeowners the chance to accessibility funds based on the worth of their residential or commercial property past the outstanding home loan equilibrium. When thinking about remodellings, leveraging home equity can provide an economical service contrasted to other types of loaning, as these lendings commonly provide reduced rates of interest because of the collateral supplied by the home.

Settling Financial Obligation With Home Equity

Combining financial debt with home equity includes taking out a financing using the equity developed up in your home as security. Equity Loan. By doing so, individuals may benefit from lower rate of interest prices supplied on home equity car loans compared to other forms of financial obligation, possibly minimizing total rate of interest expenses.

Additionally, consolidating debt with home equity can simplify the settlement procedure by combining different repayments into one, making it easier to prevent and manage finances missed out on settlements. It likewise has the prospective to improve credit history scores by reducing the total debt-to-income proportion and demonstrating responsible financial debt administration. Nevertheless, it is essential to very carefully think about the risks entailed, as failing to pay back a home equity lending could cause the loss of your home with foreclosure. Consulting with a financial consultant can help establish if combining debt with home equity is the ideal choice for your economic circumstance.

Tips for Securing a Home Equity Funding

Safeguarding a home equity lending needs thorough prep work and a comprehensive understanding of the loan provider's needs and evaluation criteria. Before requesting a home equity finance, it is vital to evaluate your monetary circumstance, including your credit rating, existing debt obligations, and the amount of equity you have in your home. Lenders usually seek a credit report of 620 or greater, a convenient debt-to-income proportion, and at the very least 15-20% equity in your house. To raise your chances of approval, consider improving your credit rating, paying down existing financial obligations, and properly calculating the equity in your house.

In addition to economic readiness, it is critical to look around and contrast deals from different lending institutions. Look for affordable passion prices, favorable lending terms, and reduced charges. Be prepared to offer documents such as image source proof of earnings, tax returns, and residential property evaluations during the application procedure. By demonstrating economic obligation and a clear understanding of the funding terms, you can enhance your opportunities of protecting a home equity lending that straightens with your requirements and objectives.

Conclusion

To conclude, home equity fundings supply a variety of advantages, consisting of the ability to gain access to funds for renovations, financial obligation loan consolidation, and other financial requirements. By leveraging the equity in your home, you can open brand-new possibilities for managing your financial resources and attaining your objectives. Equity Loans. Recognizing just how home equity car loans job and adhering to ideal practices for protecting one can assist you take advantage of this beneficial financial tool

Home equity financings are a kind of financing in which the borrower makes use of the equity in their home as security (Alpine Credits). Consolidating debt with home equity involves taking out a car loan utilizing the equity developed up in your home as collateral. Before applying for a home equity lending, it is important to evaluate your financial situation, including your credit scores score, existing debt obligations, and the quantity of equity you have in your home